داشبورد کلی کسب و کار

اگر بیش از 2 ماه اطلاعات مالی خود را دارید، می توانید از این داشبورد استفاده کنید. داشبورد کلی، وضعیت کسب و کار شما را در ماه های گذشته به تصویر میکشد.

ارزش یک تصویر بیش از هزار کلمه است

شما زمانیکه اطلاعات خود را در یک تصویر مشاهده میکنید، میتوانید تصمیمهای بهتری برای کسب و کار خود بگیرید و بهرهوری مجموعهی خود بالا ببرید.

با توجه به تجربیات مشتریان ما، یکی از مهمترین فاکتورهایی که در کسب و کار مهم است و شاید تاکنون به خوبی به آن پرداخته نشده است مسئله تصویرسازی اطلاعات است. البته فقط زمانیکه این کار استاندارد و حرفه ای انجام شود، می تواند کمک شایانی به شما بکند.

داشبورد کلی چیست؟

نسبت ها، شاخص ها و اطلاعات مالی شما بصورت مستمر در سیستم های حسابداری در حال ذخیره شدن است و شما نیز سالانه یا بسیار خوش بینانه شش ماه تراز گزارش تراز را می خوانید ولی معمولا تا وقتی که اطلاعات و دانش حسابداری نداشته باشید، این گزارش برای شما معنی خاصی ندارد.

ولی به ندرت عملکرد شما بصورت ماهانه و در مقایسه با ماه های قبل به تصویر کشیده می شود. بنابراین این فرصت ندارید تا به راحتی آنها را مقایسه کنید و از نسبتها به شاخصها و فاکتورهای مالی خود درک بهتری داشته باشید و بتوانید نقاط قوت و ضعف خود را شناخته و آن را برطرف کنید.

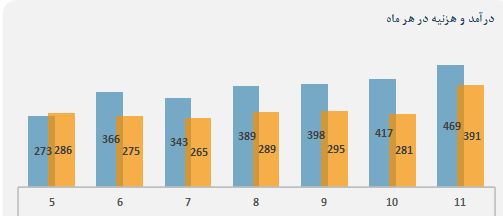

فرض کنید که تمام تاریخچه درآمد و هزینههای شما در یک نمودار بصورت یکجا نمایش داده شود و این نمودار بصورت ماهانه به روز رسانی شود.

این به شما کمک می کند تا تغییرات ماههای مختلف و دلایل اتفاقات را به خوبی مشاهده کنید. تجربه نشان میدهد که تصمیمگیریهای شما با این روش بسیار بهتر و پایدارتر خواهد بود.

البته اطلاعات و نمودارهای درآمد و هزینه فقط جزئی از این داشبورد است و تمام سرفصل های کلی هزینه مانند نیروی انسانی، محل و هزینه های مواد اولیه و دیگر هزینه ها نیز در این داشبورد مورد بررسی و نمایش قرار میگیرند.

در گزارش هایی که برای مشتریان تهیه کرده ایم، بسیار دیده شده که یک هزینه یا اطلاعاتی بصورت اشتباه در سیستم حسابداری ثبت شده و یا اینکه هزینه های تمام شده محصول بسیار نسب به فروش بالا بوده است ولی به دلیل اینکه صاحب کسب و کار آن را به موقع متوجه نشده است هزینه های سنگینی را پرداخت کرده اند و مجموعه بجای اینکه سود ده باشد، حتی در بسیاری موارد ضرر ده نیز بوده است.

امتیازها و نسبت های مالی کسب و کار

برای سنجش کسب و کار خصوصا در زمینه مالی ما از KPI ها استفاده میکنیم تا بتوانیم بهتر وضعیت کسب و کار خود را مدیریت کنیم.

این شاخصهای کلیدی همگی از استانداردها و فرمولهای کلی یکسان و بین المللی پیروی می کنند.

coaching.total--p-3-3

coaching.total--p-3-4

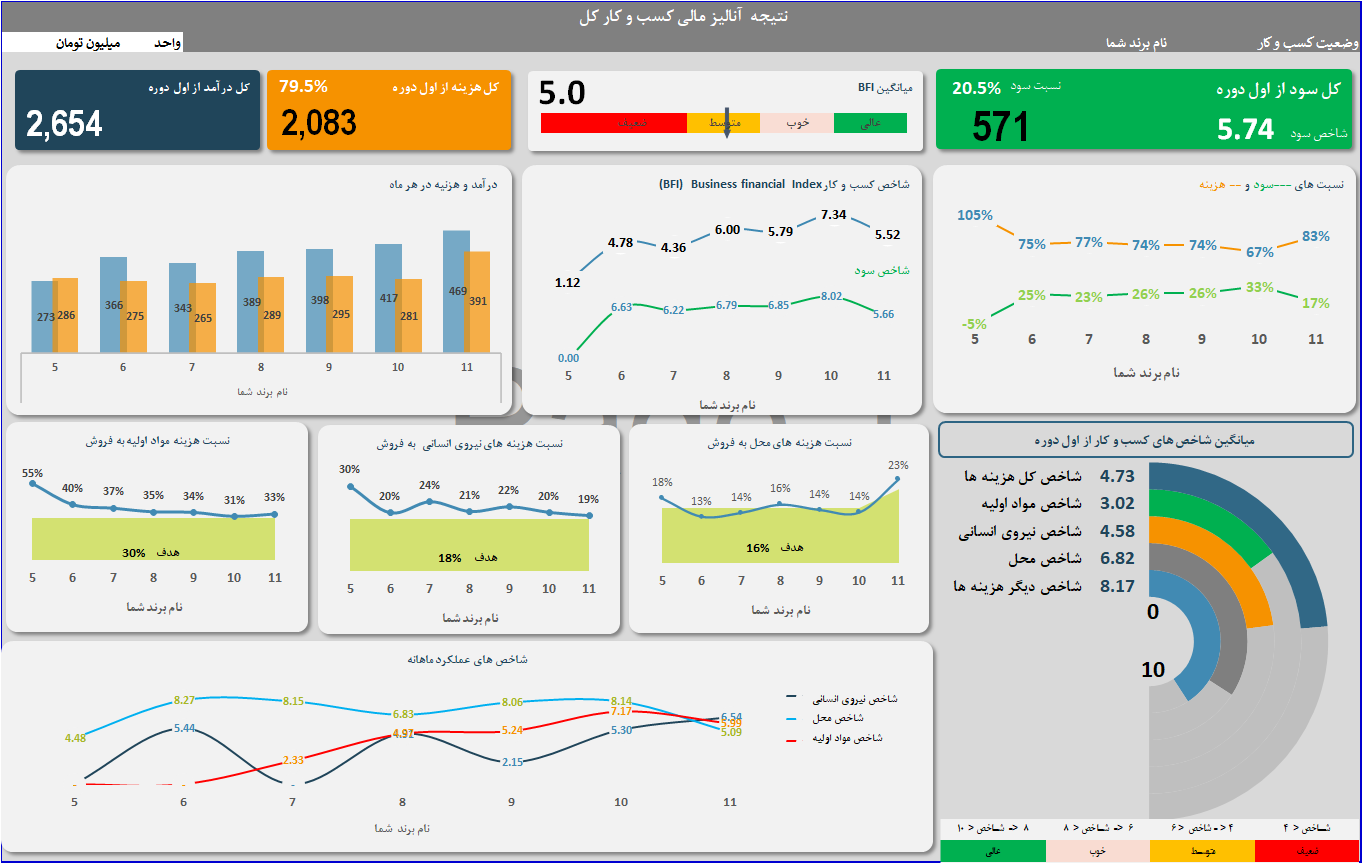

داشبوردهای مالی بصورتی ساده ولی کامل تمام اطلاعاتی که شما میخواهید را در اختیارتان میگذارد.

داشبوردی که اینجا مشاهده میکنید نمونهای از داشبورد کلی کسبوکار مجموعه AKF است که عملکرد ماه های مختلف را نشان میدهد.

شما می توانید گزارش ماهانه خود را در فرم

داشبورد مالی ماهانه

وارد نمایید و علاوه بر تهیه گزارش تخصصی و تحلیلی، بصورت ماهانه گزارش کلی کسب و کار را نیز داشته باشید.

چطور به صاحبان کسب و کار کمک کنیم؟

سوال اینجاست، اگر نیازی نیست که صاحبان کسب و کار این شاخص را بصورت حرفهای یاد بگیرند چطور آنها را در کارشان بکار بگیرند و بهره وری سازمانشان را بالا ببرند ؟

داشبورد کلی کسب و کار و داشبوردهایی که تیم FardVisor طراحی می کنند، تمام این اطلاعات را بصورت کاملا ساده

اما کامل، کاربردی و تخصصی در اختیار صاحبان کسب و کار قرار میدهند.

داشبورد ماهانه و داشبورد کلی بصورتی طراحی شده اند که با ورود اطلاعاتی بسیار خلاصه اما کامل، تمام

شاخصها، اطلاعات و تحلیلهایی که یک کسب و کار به آن نیاز دارد را بدون داشتن هیچگونه دانش مالی یا

حسابداری بدست بیاورد.

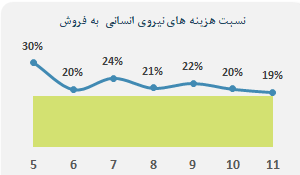

این نمودار که یکی از دهها نمودار داشبورد است، نشان میدهد که نسبت هزینههای نیروی انسانی به درآمد (تمام هزینههایی که برای نیروی انسانی در یک کسب و کار پرداخت میشود شامل حقوق و دستمزد، هزینه های اسکان، ایاب و ذهاب، خوراک و دیگر هزینه ها … ) در هر ماه چگونه بوده است.

در این مجموعه هزینههای نیروی انسانی در ماه 5 نسبت به درآمد 30٪ بوده، این مجموعه با به روز رسانی ماهانه داشبورد و مشاهده نقاط ضعف و مدیریت هزینهها و درآمد توانسته این نسبت را به 19٪ برساند. در نگاه اول شاید این 11٪ خیلی مهم به نظر نرسد. اما ...

11 ٪ به سودناخالص اضافه شده

هر کسب و کاری خصوصا در حوزه غذا بخواهد که 11 درصد سود خود را افزایش دهد، باید حدود 30 الی 40 درصد به فروش خود اضافه کند. البته اگر تمام دیگر هزینهها مانند هزینههای مواد اولیه، نیرویانسانی، محل و دیگر هزینهها ثابت باشند که مدیریت این مسئله نیز ساده نیست.

اضافه کردن 30 الی 40 درصد به درآمد در 6 ماه کار ساده ای نیست. ولی با مدیریت کردن هزینه ها خیلی سریع تر می توان حاشیه سود را بالا برد.

اگر ما ندانیم که در مجموعه ما هر کدام از فاکتورها چطور عمل می کنند، چطور می توانیم آنها را مدیریت کنیم.

چطور داشبورد کلی کسب و کار را تهیه کنیم:

شما از دو روشد می توانید نسبت به تهیه داشبورد کلی اقدام نمایید.

1. استفاده از داشبورد کلی کسب و کار پیش فرض:

ابتدا می بایست اطلاعات مالی خود را برای حداقل 2 ماه در فرم داشبورد مالی ماهانه وارد نمایید و فرم ورود اطلاعات مالی را که بسیار ساده و آسان طراحی شده اند تکمیل نمایید. پس از آن داشبورد کلی کسب و کار بصورت مقایسه ای عملکرد ماه های قبل را نشان می دهد.

سپس نسبت به تهیه داشبورد کلی کسب و کار اقدام نمایید. این داشبورد با توجه به اطلاعات ورودی ماهانه توسط الگوریتم های طراحی شده تهیه شده و برای شما ارسال میشود.

لازم به یادآوری است که این داشبوردها برای حفظ محرمانگی و عدم افشاء اطلاعات شما بصورت فایل های PDF به ایمیل شما ارسال خواهد شد.

شما من بعد پس از ورود اطلاعات بصورت ماهانه می توانید علاوه بر داشتن داشبورد مالی ماهانه، داشبورد کلی کسب و کار را نیز داشته باشید.

این داشبورد پس از بررسی کسب و کار شما و مصاحبه با کارشناسان AKF بصورت اختصاصی برای شما طراحی و اجرا می شود و بصورت ماهانه با توجه به اطلاعات ارسالی شما به روز شده و برای شما ارسال خواهد شد.

برای داشتن داشبورد کلی کسب و کار بصورت اختصاصی با ما تماس بگیرید

Persian

Persian

English

English

Turkish

Turkish